Money & Management

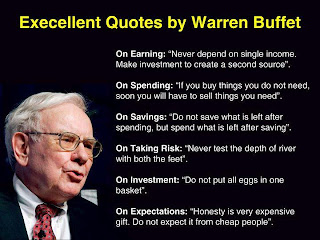

If you are an active FB person, I am sure you wouldn't have missed this 'Excellent Tips By Warren Buffet' pic that has been shared like (what???) a million times (!!) on FB. Every other person on my 'Friends' list has shared it. My Mum did too! If you havent already seen it, I would simply conclude you weren't really active on FB. Or, you don't have the right set of people on your list who share the right set of things ;)

I have always had a surplus of savings while my friends cringed about pocket money, savings and then, huge credit card bills as we grew up. Being born into a business family, I always assumed money management just came to me (yeah! just like that!) . I thought it had something to do with the genes and was transferred to all of us from Thathas and thathas from yore until, one fine day I was reading through these great tips by the great man and was like "Oh! Wait a minute! I already know all these! " and it was like a Deja vu moment.

My dad started giving my brother and me pocket money right since we were 10 years old so that we can learn the nuances of Money Management very soon in life..

Lesson 1: Dont spend all the money at once

In the beginning, we used to get all excited about the I-dont-remember-how-much amount we got every month and spend most of it (or almost all of it) in the first week itself. This amount was supposed to cover the sweet treats, chocolates and local pani puri bandi expenses. Ah! So the smart me figured out that the trick here is to spend only so much for this week and the rest in the weeks to follow.

(The brother did take some time to learn it though! He ended up begging me for money very often :P )

Lesson 2: You cannot splurge on things that you dont need

Later, as we grew the amount got increased, so did the things it had to buy us, and so did the expenses. My very-smart Mum included the fancy-not a necessity-its a style statement kind of pens and pen-pencils into this amount. So now , if you wanted to flaunt something, you had to save for that something. If you buy that something you dont need first, later you will not have enough to buy that something you need.

Lesson 3: Saving Pays.

When I saved my first 1000, my maternal grandfather asked me if he could borrow that 1000 from me and that he will pay me an interest of Rs.2 every month for every 100 that he borrowed. So my Rs.1000 was safe with him while it generated an additional Rs.20 for me every month and it is a different thing alltogether that no bank can ever match that interest rate.

This happened while I was still in school and I thought I was doing my grandpa a favor in his business by lending that amount and that he was using my 1000 and earning more out of it :P

Slowly this 1000 became 10000 and the Rs.20 became Rs.200 every month. Even before I realized , I started keeping this 200 aside to make 1000s and so on and so forth (investment goal huh!)

Some 10~12 years later I realize that he had actually taught me the lesson and love of saving by this entire act.

These were my basics at money management and I feel if you stick to these everything else will fall in place. There are a 1000000 ways to save and invest, and plan for future. Tracking your incomes, expenditures, setting realistic goals and these excellent guidelines by the Great Mr.Buffet himself will keep you prepared up for the loooooong journey called LIFE!!!

I have always had a surplus of savings while my friends cringed about pocket money, savings and then, huge credit card bills as we grew up. Being born into a business family, I always assumed money management just came to me (yeah! just like that!) . I thought it had something to do with the genes and was transferred to all of us from Thathas and thathas from yore until, one fine day I was reading through these great tips by the great man and was like "Oh! Wait a minute! I already know all these! " and it was like a Deja vu moment.

My dad started giving my brother and me pocket money right since we were 10 years old so that we can learn the nuances of Money Management very soon in life..

Lesson 1: Dont spend all the money at once

In the beginning, we used to get all excited about the I-dont-remember-how-much amount we got every month and spend most of it (or almost all of it) in the first week itself. This amount was supposed to cover the sweet treats, chocolates and local pani puri bandi expenses. Ah! So the smart me figured out that the trick here is to spend only so much for this week and the rest in the weeks to follow.

(The brother did take some time to learn it though! He ended up begging me for money very often :P )

Lesson 2: You cannot splurge on things that you dont need

Later, as we grew the amount got increased, so did the things it had to buy us, and so did the expenses. My very-smart Mum included the fancy-not a necessity-its a style statement kind of pens and pen-pencils into this amount. So now , if you wanted to flaunt something, you had to save for that something. If you buy that something you dont need first, later you will not have enough to buy that something you need.

Lesson 3: Saving Pays.

When I saved my first 1000, my maternal grandfather asked me if he could borrow that 1000 from me and that he will pay me an interest of Rs.2 every month for every 100 that he borrowed. So my Rs.1000 was safe with him while it generated an additional Rs.20 for me every month and it is a different thing alltogether that no bank can ever match that interest rate.

This happened while I was still in school and I thought I was doing my grandpa a favor in his business by lending that amount and that he was using my 1000 and earning more out of it :P

Slowly this 1000 became 10000 and the Rs.20 became Rs.200 every month. Even before I realized , I started keeping this 200 aside to make 1000s and so on and so forth (investment goal huh!)

Some 10~12 years later I realize that he had actually taught me the lesson and love of saving by this entire act.

These were my basics at money management and I feel if you stick to these everything else will fall in place. There are a 1000000 ways to save and invest, and plan for future. Tracking your incomes, expenditures, setting realistic goals and these excellent guidelines by the Great Mr.Buffet himself will keep you prepared up for the loooooong journey called LIFE!!!

Comments

Can you be my CA? I can pay well you know. Likeyou take a share of whatever you save off my earnings??

Deal?

But send me your bank details, balance sheets, etc etc first :P